About How To Form A Llc

In a couple of states, you must take an additional step to make your company official: You need to release a simple notice in a local paper, specifying that you plan to form an LLC. You are required to publish the notice numerous times over a duration of weeks and after that send an "affidavit of publication" to the LLC filing workplace.

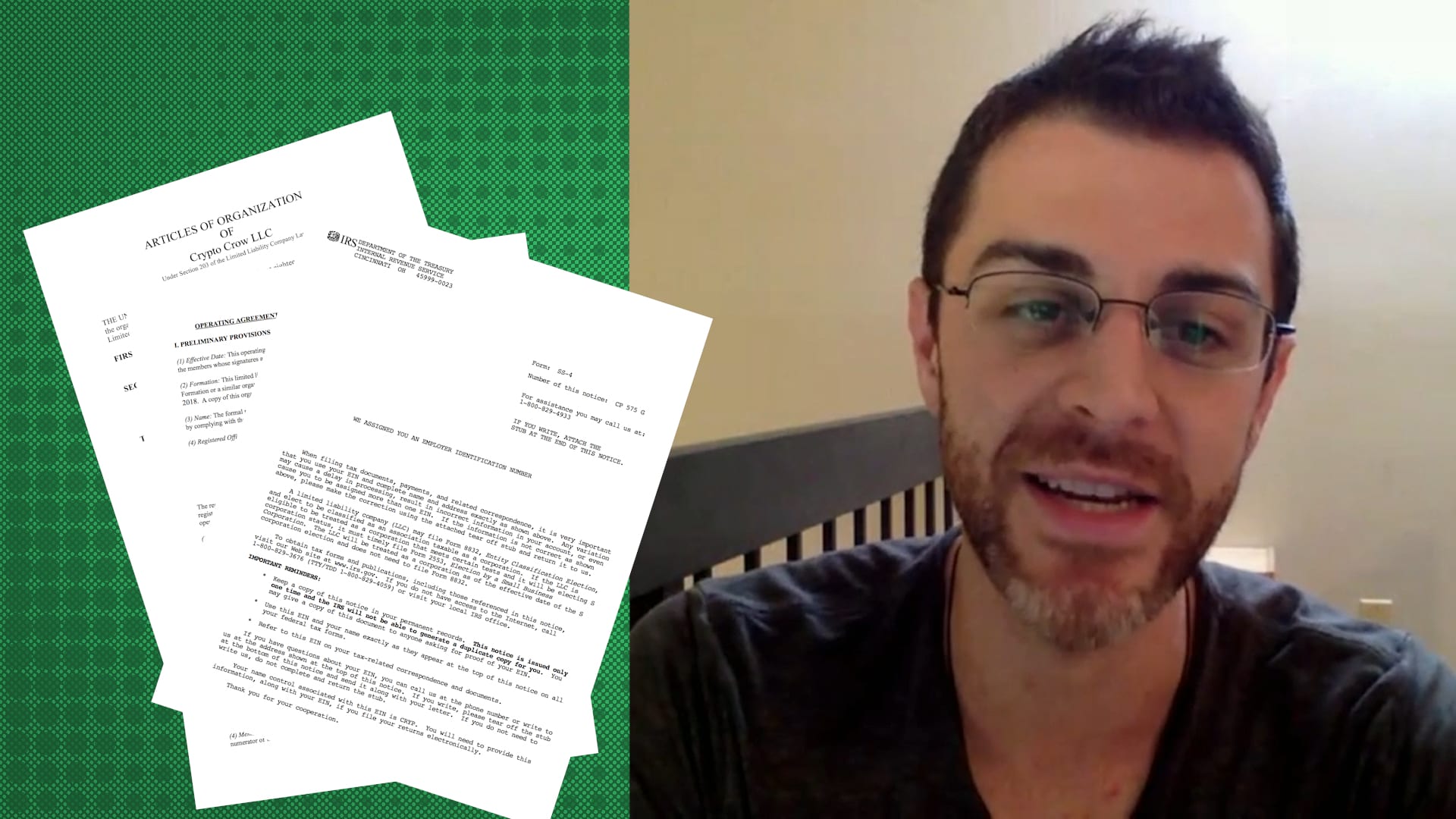

After you've completed the steps described above, your LLC is main. But before you open your doors for business, you require to acquire the licenses and permits that all brand-new services need to need to operate. These might consist of a service license (sometimes likewise described as a "tax registration certificate"), a federal employer identification number, a sellers' license, or a zoning license.

A Restricted Liability Company is a company structure formed under specific state statutes. It is a different legal entity from its owners (referred to as "members"). An LLC can be formed as either a single-member LLC or a multi-member LLC and either member-managed or manager-managed. The LLC is the formal business structure that is most basic to form and keep.

Company owners that are trying to find individual liability security, tax flexibility, and management alternatives may discover that forming an LLC (Restricted Liability Company) will be an ideal option for their company. Next to running a business as a sole proprietor or basic collaboration, the LLC structure is the least complex and expensive form of business to start and maintain from a state compliance perspective.

Due to the fact that an LLC is thought about a separate legal entity from its members, its monetary and legal duties are also its own. So, if someone sues the company or the business can not pay its financial obligations, the LLC members are generally not held responsible. For that reason, their personal properties are at lower danger of being taken to pay legal damages or settle financial obligation than they would be if business were a sole proprietorship or partnership.

![]()

The 8-Second Trick For How To Form A Llc

As such, income tax is used in the exact same way as it is to sole proprietorships and collaborations-- with service earnings and losses travelled through to its members' income tax return and subject to members' private tax rates. An LLC has other tax treatment choices, too. Members can go with an LLC to be taxed as a corporation, with profits taxed at its business rate.

An LLC might be either member handled or manager handled. In a member-managed LLC, the owners manage the day-to-day management of business. In a manager-managed LLC, members designate several supervisors to handle the business. In most states, an LLC can appoint members of the LLC to be managers, or it can employ somebody else to do the task.

Most states think about an LLC to be member-managed unless the development documents shows it should be manager-managed. Forming an LLC requires filing Articles of Organization with the state in which the LLC will run. Corp Net can sign up an LLC in all 50 states to allow them to conserve money and time-- and to ensure their files are sent precisely.

An LLC is required to have an EIN to open a savings account, apply for authorizations and licenses, work with workers, and perform other company activities. An LLC can get an EIN totally free from the Irs. An organisation can likewise ask Corp Net to manage finishing and sending EIN paperwork on its behalf.

Even in states that don't need running contracts, an LLC (especially one has multiple members) may find one handy for preventing misunderstandings about who ought to be doing what and who has the authority to ensure choices. An LLC might require to have numerous service licenses and permits to operate in the state or local area legally.

Facts About How To Form A Llc Uncovered

Company owners should examine with the regional town, county, and state to see what requirements apply to them. Corp Web can also supply extra info about licenses and licenses. An LLC must keep its finances different from its owners. For that reason, it's important to open an organisation savings account and use it only for the functions of the LLC.

An LLC must likewise pay attention to the continuous compliance requirements it should meet to remain a legal entity in good standing with the state. Compliance commitments vary from one state to the next. Some typical examples of what many LLCs require to take note of include: Filing taxes Restoring licenses and allows Filing annual reports with the state Holding member conferences and taking conference minutes Updating the state about considerable modifications in business (e.g., modification in address or adding a brand-new member) Choosing a company entity type for your company has both legal and monetary implications.

If you have actually see it here decided that forming an LLC is best for your company, Corp Net is here to help you manage all of the filings to begin your company and keep it certified-- in any state! Contact us to conserve you money and time and get the peace of mind that your filings will be completed properly, on time, and economically with a 100% guaranteed.

Lots of little business owners choose to establish an LLC for the liability security it supplies. An LLC, or restricted liability business, exists separately from its owners (referred to as members), and the owners are for that reason not personally accountable for business debts. LLCs are normally simpler to set up and more flexible than corporations, and they tend to have fewer ongoing reporting requirements.

Every state has its own rules and treatments, but there are a number of steps you'll require to follow to get your LLC up and running, no matter where you live. Step 1: Choosing a Name for Your LLC Most states do not enable 2 different company entities to have the exact same name.